When it comes to sport apparel, the struggle for market share between adidas and Nike stretches back for decades, particularly in the US. But recent data suggests adidas is pulling ahead of Nike in its home market for the first time ever. Iris’s Participation Branding Index shows the areas in which adidas is using participation to gain an edge on its rival.

adidas has always had cultural cachet, from its endorsement with Run DMC to today’s collaborations with Beyoncé and Pharrel Williams. But when it comes to actual sport apparel – the clothes you wear to perform – Nike has traditionally had the edge, and particularly in its home market of the US. Until now.

Recent research from Morgan Stanley has shown that, for the first time ever, adidas has overtaken Nike in both sport shoes and sport apparel in the US. This is a pivotal moment in the brand’s history, but how has adidas achieved this?

When you look at Iris’s Participation Brand Index it’s interesting to see that, at a global level, the two brands have very similar scores in every dimension of participation. But when you isolate the US market, some key differences emerge that clearly put adidas ahead in terms of participation. Let’s have a look at the five areas where adidas has the biggest advantage over Nike.

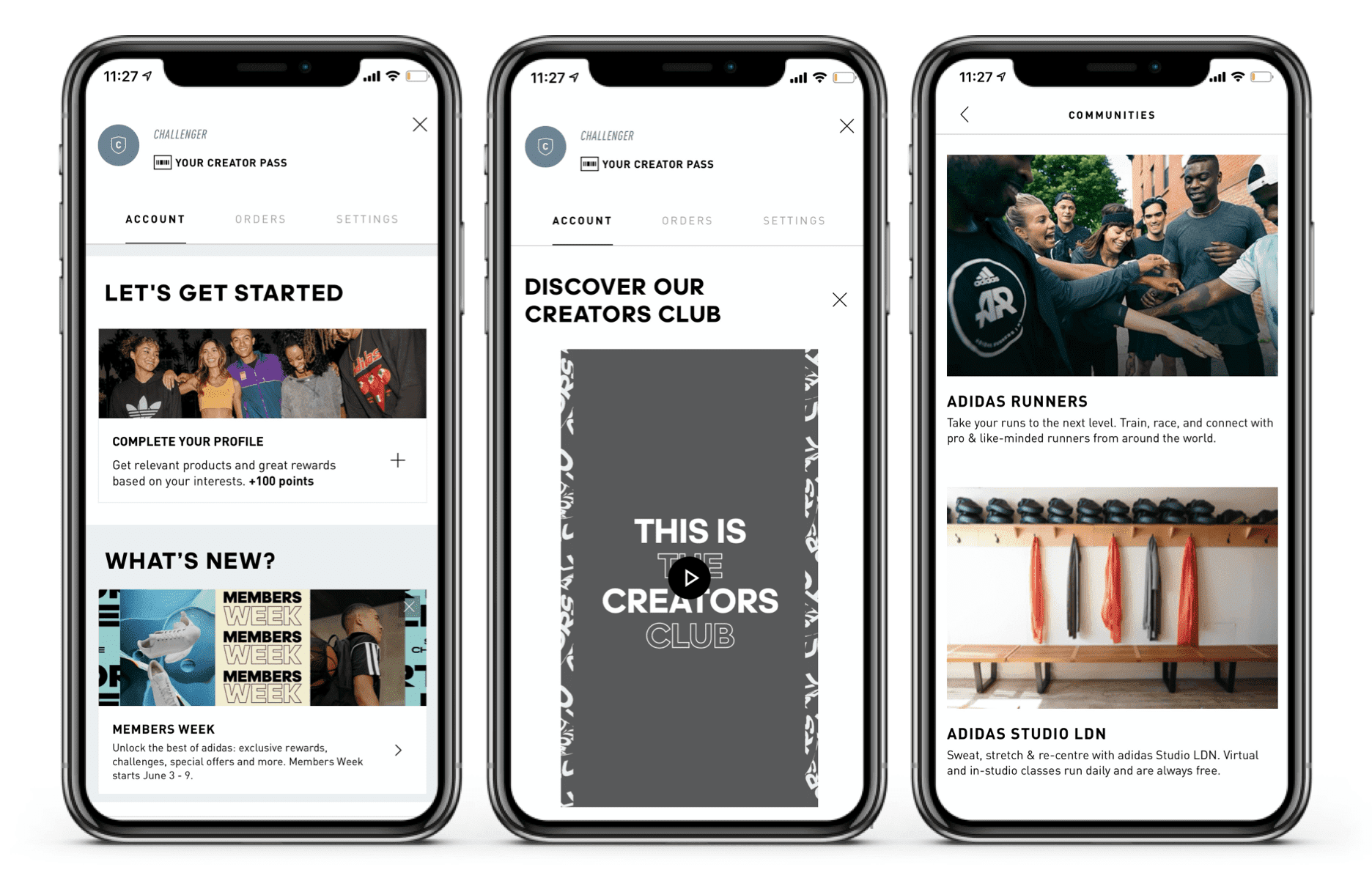

The Creators Club is adidas’s flagship CRM programme and it offers a huge amount to its members. Digitally enabled through an ever-improving app, even at the lowest loyalty tiers customers are immediately able to access free delivery on e-commerce orders, and become part of real-world sporting communities.

As customers move up the tiers, they unlock new features, free access to training apps and bonuses on their birthday. At the top-level customers gain access to special events and the latest editions of sport apparel.

adidas’s Creator Club is CRM with participation built into its DNA, incentivising its customers to participate with the brand over time.

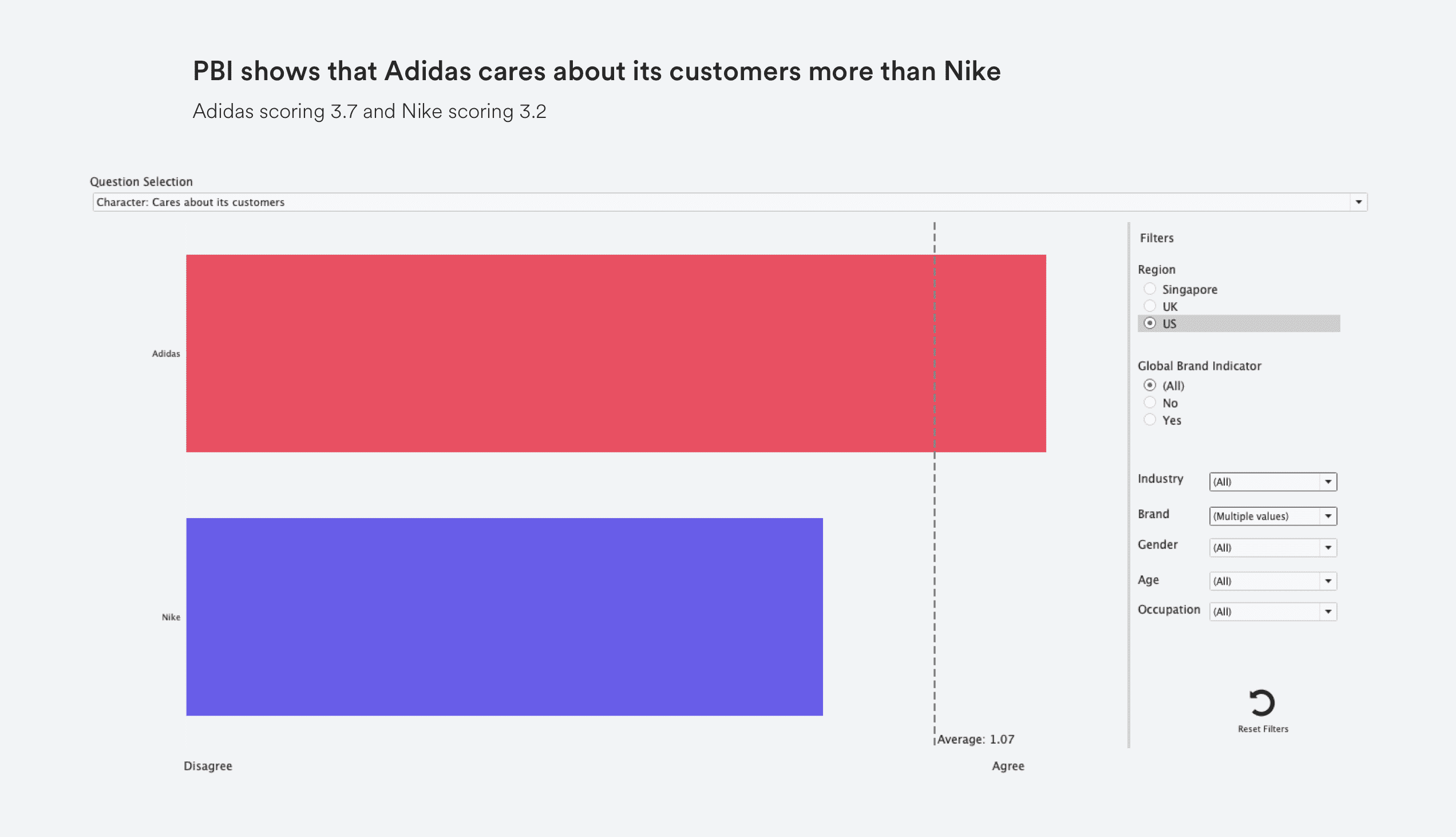

The Participation Brand Index shows that adidas cares about its customers more than Nike, with at adidas scoring 3.7 and Nike scoring 3.2

The creators club app

With the average running shoe costing anywhere between 13-14kg of CO2 emissions, the industry’s shoe obsession has a monumental impact on our environment.

adidas has spent years working on its impact to stay ahead and drive sustainability. Most recently, their efforts have made headlines as a world leader in sustainable footwear. In just 12 months, an unlikely collaboration with competitor Allbirds saw the co-design, manufacture and reveal of the Futurecraft Footprint – a running shoe with the world’s smallest carbon footprint. The new shoe features a clean design with a stamp on the sole to remind wearers each pair costs the planet just 2.94kg of CO2 emissions.

The Futurecraft Footprint has shown that adidas can boldly lead its customers to participate in building a more sustainable future.

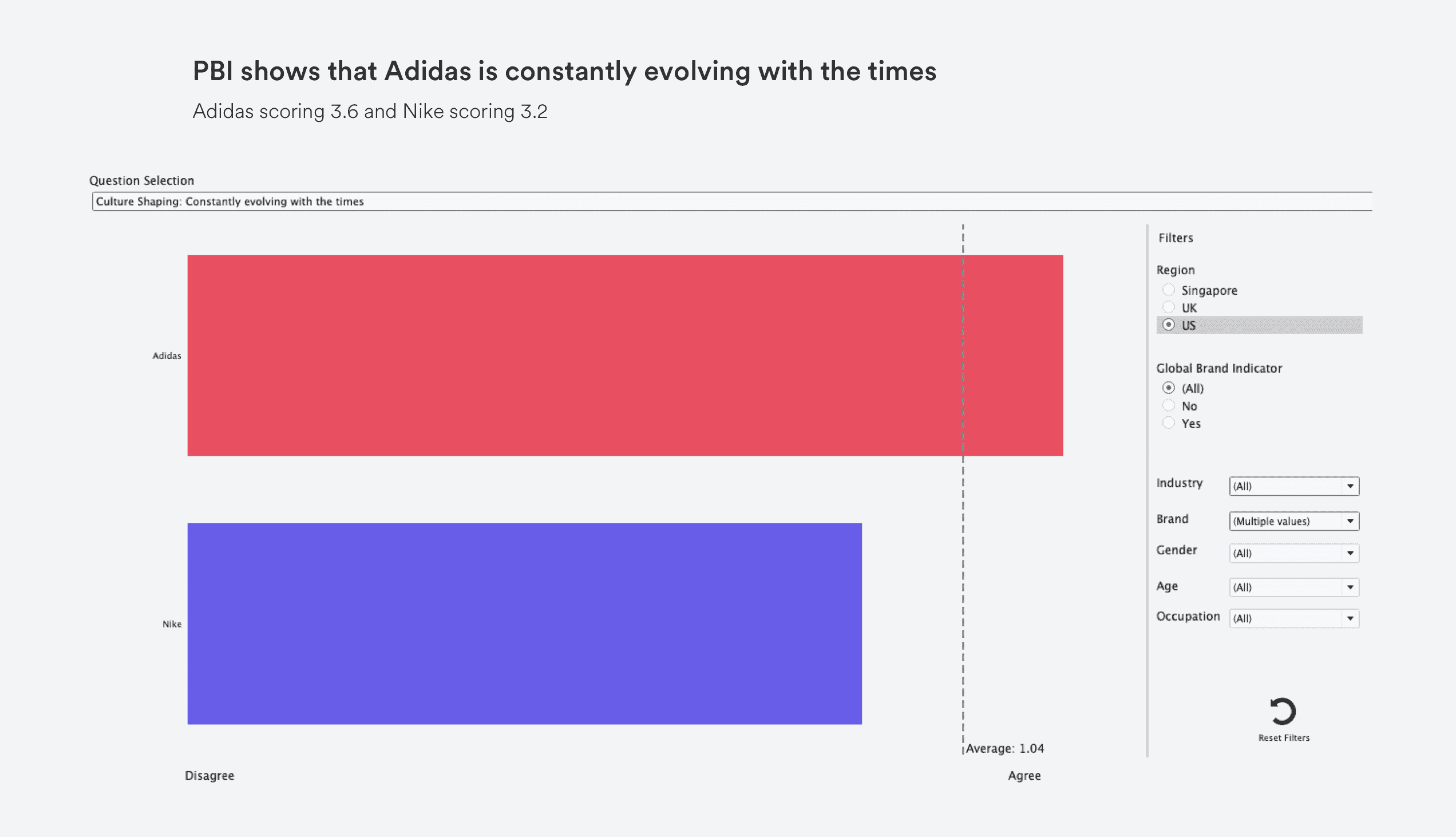

The Participation Brand Index shows that adidas is constantly evolving with the times with adidas scoring 3.6 and Nike scoring 3.2

Futurecraft Footprint

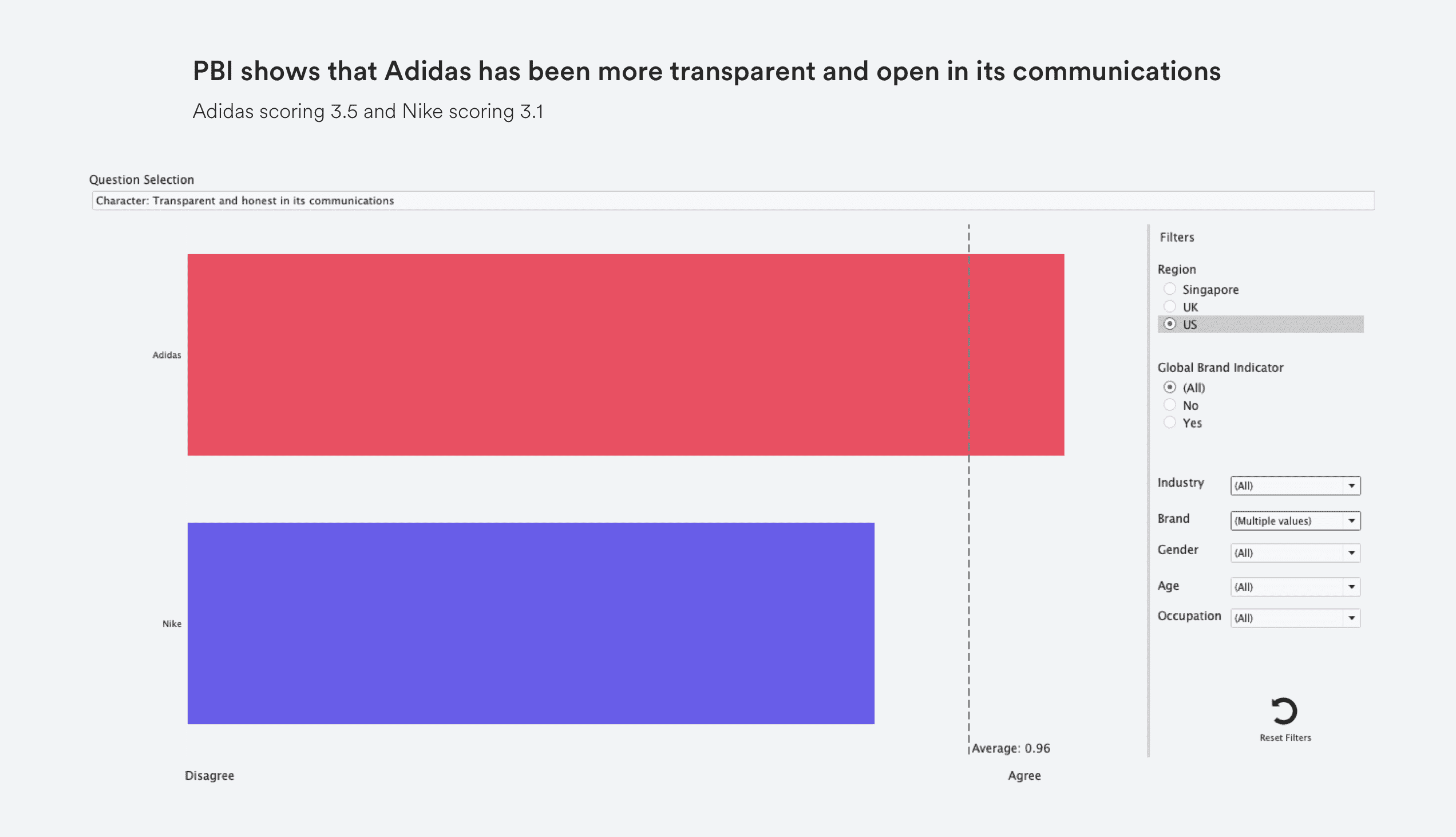

It’s interesting that the Participation Branding Index is derived from data captured at the beginning of 2021. During the Black Lives Matter protests of 2020, adidas was criticized for a lack of equitable practices, particularly in the US at its Portland HQ.

The brand’s response? An open, transparent and honest response about mistakes it had made in the past and concrete actions to commit to improvement in everything from its hiring practices to the way it conducts customer research and the way in which it works with athletes and entertainers.

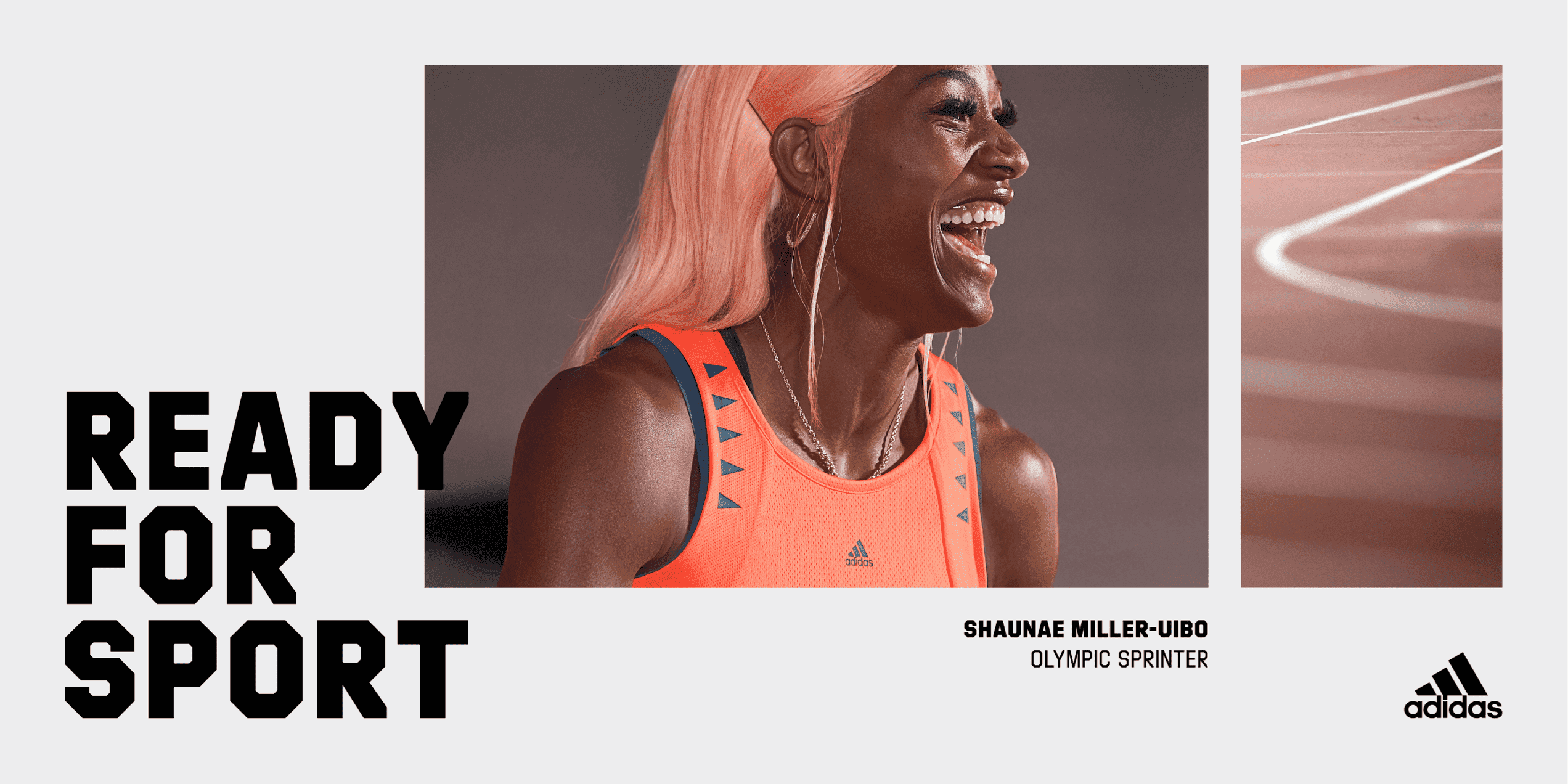

It also pivoted its global ‘Ready For Sport’ campaign to address the Black Lives Matter riots, in the US going as far as changing the line to Ready For Change. A series of films featuring high profile black athletes Patrick Mahomes, Candace Parker and Donovan Mitchell saw Adidas providing a platform for its sponsored talent to voice their opinions about the protests.

This transparency and openness clearly resonated with US consumers, creating clear space between the brand and Nike.

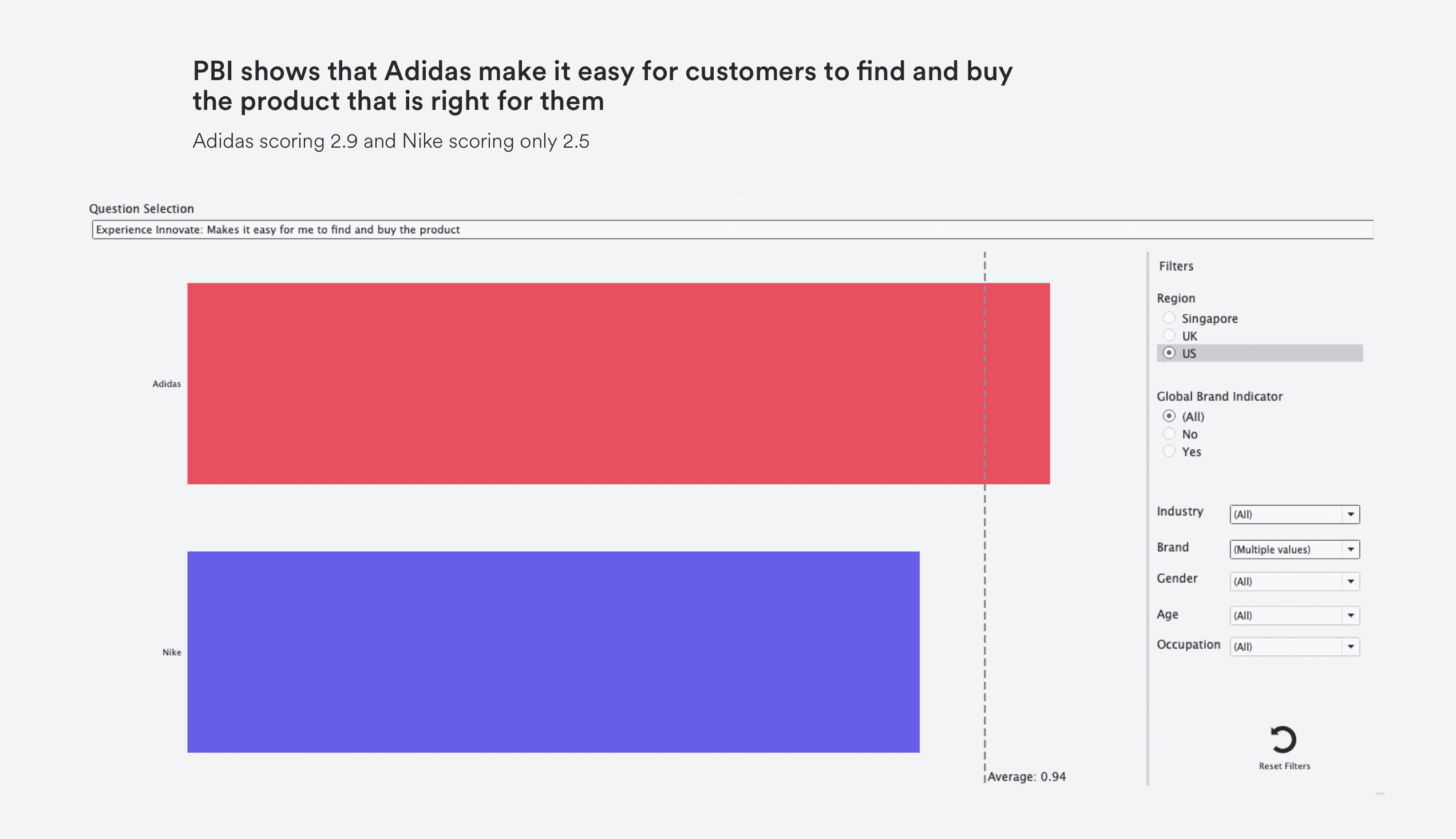

Back in 2019 Kasper Rorstad, adidas’s CEO, said ‘the most important store we have in the world is .com, period’. And that ruthless focus on the e-commerce shopping experience has helped the brand pull away from the competition in the eyes of US consumers when it comes to being easy to buy.

Intuitive UX that enables customers to filter products by use case, as opposed to just colour or size, allows people to find the right product for them simply and effectively. Simple touches such as sizing guides that let you know whether products tend to come up big or small reduce the jeopardy involved with purchase.

AI chatbots, order tracking, generous returns policies, and full integration of the Creators Club CRM programme provides users with a seamless experience. It continues to be a source of strategic advantage for the brand, with e-commerce sales nearly doubling in 2020.

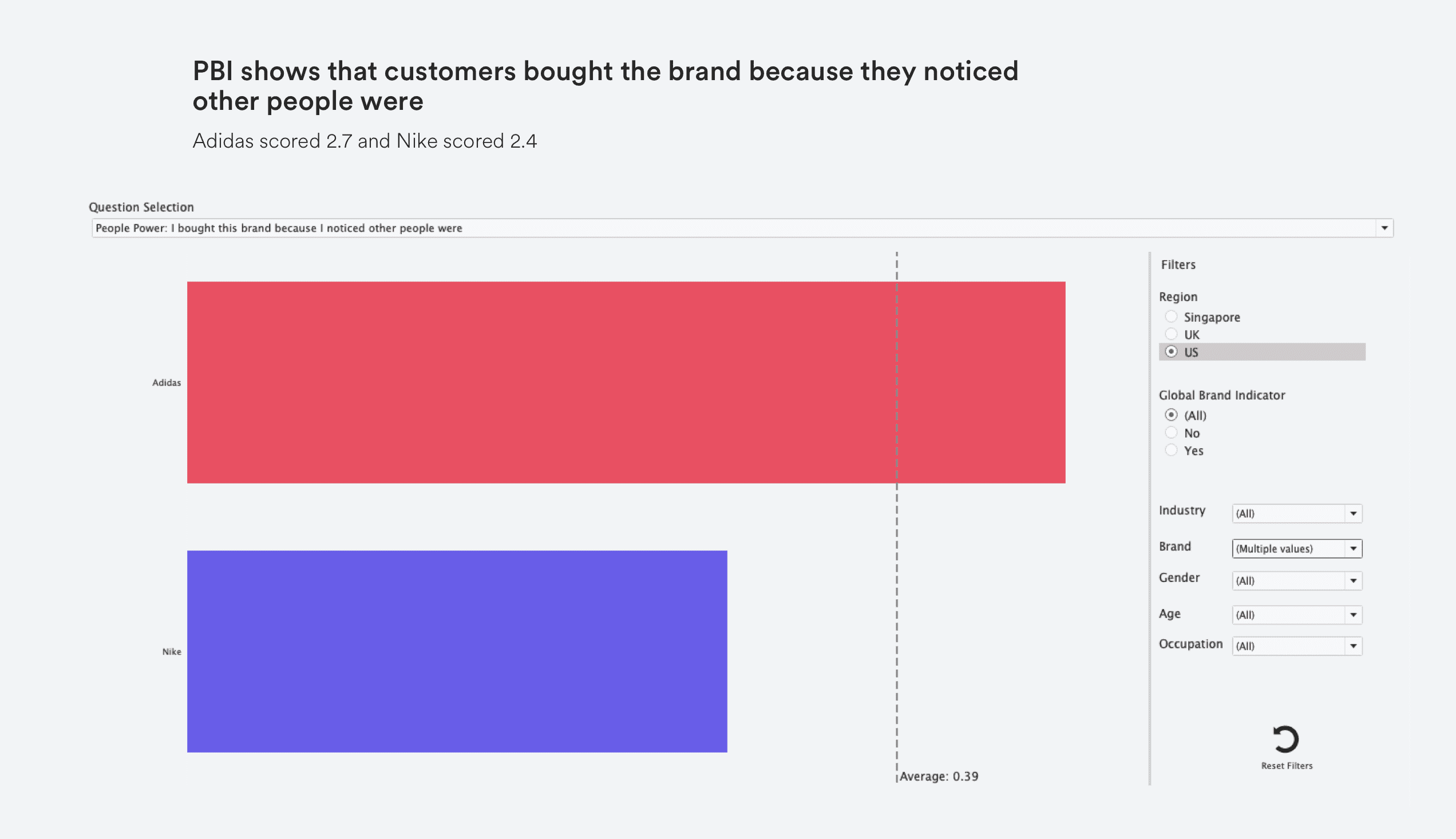

adidas has led the pack with influencer marketing and paved the way for other brands to take note on how to build a relatable brand. Their strategy goes far beyond the world of sport, spanning a breadth of pop, street and sub-cultures.

Their success is deep-rooted in an understanding that in order to reach everyday customers, you need to work with everyday people. Instead of just inspiring people with celebrities like Beyoncé and Pogba, adidas has driven participation through hundreds of micro-influencers with the power to tap into its audience; through relatable people conveying a relatable message.

The Participation Brand Index shows that customers bought the brand because they noticed other people were. adidas scored 2.7 and Nike scored 2.4

Eshan Abass: adidas’ Small Scale Influencer

adidas and Nike have been going head-to-head for years. But as our Participation Brand Index clearly shows, adidas is pulling ahead of Nike in its home market for the first time ever.

In a year like no other, care, transparency and a focus on ease and simplicity has helped adidas claim a greater role in their customers lives and in the cultural conversation.

Their approach to participation branding has helped them evolve with the times and stay culturally relevant for customers.